- Share on Facebook

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Skype

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

- Bluesky

By Lucia Valentine and Maria Russo, WVEC Lobbyists

We are over 60 percent of the way through the 2023 Legislative Session! In continuation of last week, we changed our format from a weekly round-up to a breakdown of bills we are working on getting passed and those we are trying to defeat, along with steps you can take.

The last day to introduce bills in the House was Tuesday, February 14th. The last day to introduce bills in the Senate is Monday, February 20th. We’re gearing up for Crossover Day, quickly approaching on March 1st!

Bills We Support

Energy

SB627 – Establishing a solar program for subscribers to gain credits against their utility bills

Sponsors: Rucker (Lead), Oliverio

Last Action: Introduced on 2/14 and referred to Senate Government Organization Committee

Summary: This bill creates a community solar program where individuals, businesses, and organizations can purchase or subscribe to a “share” in a locally sited solar panel array and use credits against their electric utility costs. This legislation establishes parameters and conditions for the program and provides for administration and rulemaking by the Public Service Commission. Community solar offers the benefit of solar to those who can’t, or prefer not to, install solar panels on their own homes.

HB 2159 – Establishing a community solar program for subscribers to gain credits against their utility bills

Sponsors: Hansen

Last Action: Referred to House Energy and Manufacturing on 1/11

Summary: This bill would establish a community solar program in West Virginia, legalizing the ability for subscribers to gain credits against their utility bills. Since only around 34% of homes qualify for rooftop solar projects, this would allow access to solar energy for people who otherwise would not be able to benefit.

We are working on securing bipartisan support for these bills in both the House and Senate.

Office of Oil and Gas Inspector Funding

SB 448 – Providing funding for the WV Department of Environmental Protection’s (DEP) Office of Oil and Gas

Sponsors: Smith (Lead), Clements, Woodrum

Last Action: Passed Senate Energy Committee on 2/1 and awaits action in Senate Finance

Summary: Provides additional funding to the WV DEP’s Office of Oil and Gas (OOG) for increased inspectors for oil and gas wells. SB 448 and HB 3110 take a tiered approach to a fee structure and take 0.75% of the severance tax towards inspection increases. This approach provides the OOG with $2.1 million and would allow the WV DEP to increase inspectors from 10 to around 20, less than the 40 inspectors needed to align WV with the oversight capacity of PA and OH.

HB 3110 – Relating to funding the Office of Oil and Gas in the Department of Environmental Protection. Companion bill to SB 448 (above).

Sponsors: Anderson (Lead), Zatezalo, Horst, Hansen, Fehrenbacher, Cooper, Martin, Young, Hardy, Heckert

Last Action: Passed House Energy on 2/3 and passed House Finance on 2/13. On Tuesday, 2/14, the bill received a committee substitute in the Finance Committee, which eliminated the third tier of the three-tiered system. After being sent to the House Floor and then back to the Finance Committee, it was re-amended to only include fees on wells for producers with 500 or more wells. This bill returned to the House Floor and was on first reading today, 2/17.

SB 13 – Establishing annual oversight fee for wells producing more than 10,000 cubic feet of gas per day

Sponsors: Smith

Last Action: Passed Senate Energy on 2/3 and awaits action in Senate Finance

Summary: Provides additional funding to the WV DEP’s Office of Oil and Gas (OOG) for increased inspectors for oil and gas wells and an annual oversight fee per well, with a $100 fee for wells producing 10 MCF/day of gas or greater. This would get the OOG back to 1 inspector per ~4,000 wells, which was the existing ratio before budget cuts in 2019.

HB 2021 – Relating to funding for the WV DEP’s Office of Oil and Gas

Sponsors: Hansen

Last Action: Introduced on 1/11 and has been referred to House Energy, then Finance

Summary: Unlike SB13 (above), ALL wells must pay an annual fee of $100, resulting in approximately $6.5M for the OOG annually.

Action Opportunity: Please contact the Senate Finance Committee regarding SB 448. The message: Please bring West Virginia in line with our neighbors in Pennsylvania and Ohio to fully staff the WV DEP’s Office of Oil and Gas inspectors to help ensure proper enforcement of regulations and safeguard public health.

Clean Drinking Water

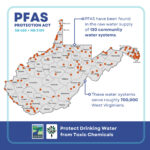

HB 3189 – The PFAS Protection Act

Sponsors: Riley (Lead), Hansen, Westfall, Clark, Horst, Hanshaw (Mr. Speaker), Hornby, Steele, Storch, Hardy, Hillenbrand

Last Action: Passed the House Energy Committee on 2/9; heads to House Judiciary

Summary: The PFAS Protection Act is a follow-up to the Department of Environmental Protection’s (DEP) 2020 study, which found alarming amounts of PFAS in over 130 water systems in West Virginia (49% of systems). This legislation requires the DEP to develop action plans to identify and address the sources of PFAS in raw water, requires the industry to monitor and report PFAS discharges, and establishes statewide limits on PFAS discharges into water supplies immediately upon the EPA’s issuance of recommended criteria (coming soon). Ultimately, the PFAS Protection Act helps hold polluters responsible for cleaning up PFAS, not water utilities or their ratepayers.

SB 485 – PFAS Protection Act

Sponsors: Smith (Lead), Caputo, Oliverio, Jeffries, Plymale, Rucker, Woodrum, Barrett, Queen, Woelfel, Chapman, Trump, Hamilton

Last Action: Passed the Senate Agriculture & Natural Resources Committee on 2/6; moving on to Finance

Summary: SB 485 was replaced by HB 3189 through a committee substitute in the Senate Agriculture & Natural Resources Committee. Please see the description of HB 3189 above.

Action Opportunity: Please contact the Senate Finance Committee regarding SB 485 and the House Judiciary Committee regarding HB 3189. The message: Please add the PFAS Protection Act to the (Finance/Judiciary) committee agenda and support this legislation. West Virginians deserve clean drinking water, and this bill protects our water systems across the state from toxic chemical pollution. You can also email House Judiciary Committee members here.

Bills We Oppose

Forest Carbon Sequestration

HB 3294 – Ensuring future economic development with limitations, excise tax, and registration requirements of carbon offset agreements

Sponsors: Anderson, Zatezalo, Westfall, Fehrenbacher, Street, Crouse, Heckert, Bridges, Holstein, Cooper, Hanshaw (Mr. Speaker)

Last Action: Passed House Energy committee on 2/8 and awaits action in House Finance

Summary: Both of these bills change the Managed Timberland Program in the following ways: 1.) threatens landowners’ eligibility in the program even if a landowner chooses to harvest timber 2.) imposes new taxes that limit landowners’ choices 3.) dictates the types of contracts landowners can enter. This bill would effectively kill the opportunity and incentive for landowners to practice stewardship and gain forestry support to maintain their managed timberland.

SB 595 – Relating to real property, tax, and registration requirements associated with carbon offset agreements

Sponsors: Tarr, Martin, Woodrum

Last Action: Introduced in the Senate on 2/9 and referred to the Finance committee

Summary: See the above summary (HB3294).

Action Opportunity: Please contact the Senate Finance Committee regarding SB 595 and the House Finance Committee regarding HB 3294. The message: I urge you to vote NO on HB 3294/SB 595 and reject this harmful policy that threatens the freedom of West Virginia forest owners. The Nature Conservancy and the West Virginia Land and Mineral Owners Association also oppose these bills.

Public Lands

SB 468 – Continuing Cabwaylingo State Forest Trail System

Sponsors: Hamilton, Maynard, Stover, Plymale, Taylor, Stuart, Karnes

Last Action: Committee Substitute failed to pass previously. Awaiting possible new action in the Senate Outdoor Recreation Committee.

Action Opportunity: Contact Senate Outdoor Recreation Committee members and tell them WV citizens do NOT want off-road vehicles on our state parks, forests, wildlife areas and rail trails.

Bills We Are Watching:

Zoning

HB3446 – Clarifying the powers and duties of the Public Service Commission as to electric generating facilities

Sponsors: Howell, Anderson, Westfall, Marple, Storch, Keaton, Maynor

Last Action: Introduced in the House on 2/14 and referred to House Energy

Summary: This bill extends the PSC’s jurisdiction over electric generating facilities, exempting these facilities from local control. An exemption like this takes away protections in residential areas and has the power to change the landscape of communities.

Severance Taxes on Coal

HB 3304 – Providing an exemption from the severance tax for coal sold to coal-fired power plants located within the State of West Virginia

Sponsors: Reynolds, Bridges, Sheedy, Crouse, Hott, Zatezalo, Willis, Phillips, Brooks, Ward

Last Action: Passed House Energy and Manufacturing on 2/14 and referred to House Finance

Summary: This bill aims to encourage and incentivize the sale of thermal or steam coal to coal-fired electric generating facilities located in West Virginia that serve West Virginia residents by exempting the sale of such coal from the severance tax, thereby providing cheaper electricity to the State’s residents. However, this bill has constitutional concerns, as it discriminates against out-of-state coal producers by discounting coal prices for in-state utilities.

HB 3133- Create a credit against the severance tax to encourage private companies to improve the infrastructure of this state’s highways, roads and bridges.

Sponsors: Barnhart, Ferrell, Reynolds

Last Action: Passed out of House Technology and Infrastructure on 2/9 and referred to House Finance

Summary: This legislation provides two significant tax breaks to the coal industry and could cost nearly $100 million annually in the state’s coal severance tax revenue. Read more here.

Now that we are over halfway through, we expect things to intensify and move quickly over the next few weeks. Keep an eye out for action alerts! If you have any questions or concerns about any bills, please reach out to Lucia Valentine (luciavalentine10@gmail.com) or Maria Russo (maria.spring.russo@gmail.com).

I’d love insight on HB 2896 – Regular Session 2023. There is potential for this bill to negatively impact environmental health and justice efforts in West Virginia in several ways. First, it does not appear to address the storage and handling of radioactive materials within residential communities, which could potentially expose residents to hazardous levels of radiation. This could have a disproportionate impact on low-income and minority communities, as they are often located near hazardous waste sites.

What Frank Rocchio said!

I’d love insight on HB 2896 – Regular Session 2023. There is potential for this bill to negatively impact environmental health and justice efforts in West Virginia in several ways. First, it does not appear to address the storage and handling of radioactive materials within residential communities, which could potentially expose residents to hazardous levels of radiation. This could have a disproportionate impact on low-income and minority communities, as they are often located near hazardous waste sites.