The West Virginia Department of Environmental Protection presented its budget last week to the House Finance Committee. The most substantive part of the discussion following the presentation from Secretary Huffman was a request from Del. Nancy Peoples Guthrie, who asked Secretary Huffman to provide to the committee information regarding when the last time civil penalties maximums were adjusted. Secretary Huffman agreed to provide that information to the committee, but volunteered the information that surface mining civil penalties have never been increased since the regulations were first established decades ago.

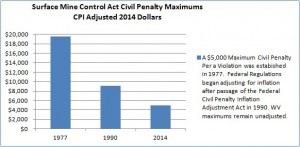

Del. Guthrie phrased the need to adjust civil penalty maximums as a necessity to ensure “we are keeping up with the times.” In 1990 Congress passed the Civil Penalties Inflation Adjustment Act of 1990, in an effort to maintain the deterrent effect of civil monetary penalties and promote compliance with the law. The Civil Penalties Inflation Adjustment Act of 1990, as amended by the Debt Collection Improvement act of 1996, requires federal agencies to regularly adjust civil monetary penalties for inflation.

There is much legal debate as to whether federal programs delegated to the states, such as the Surface Coal Mine Reclamation Act, are required to make adjustments at the state level. Regardless of the ambiguity in the law, adjustment of civil penalty maximums at the state level is essential to maintaining adequate enforcement and is also a tool for increasing revenue in a tight budget.

In 2013, the WVDEP collected $423,898 in penalties assessed to coal mines not including clean water act violations. If that amount of civil penalty revenue is adjusted for inflation since 1990, which is the rate at which the federal surface mining violations are assessed, the WVDEP would have collected $755,547 in civil penalties adding nearly $400,000 to the budget.

Hopefully the information provided back to the House Finance Committee prompted by Del. Guthrie last week will provide the committee with the appropriate information needed to introduce and pass legislation adjusting all civil penalties in WVDEP enforcement programs to keep up with the times, shoring up revenue in a tight budget.

The WVDEP is scheduled to present its budget to the Senate Finance Committee at 3 PM on Thursday, February 5th.